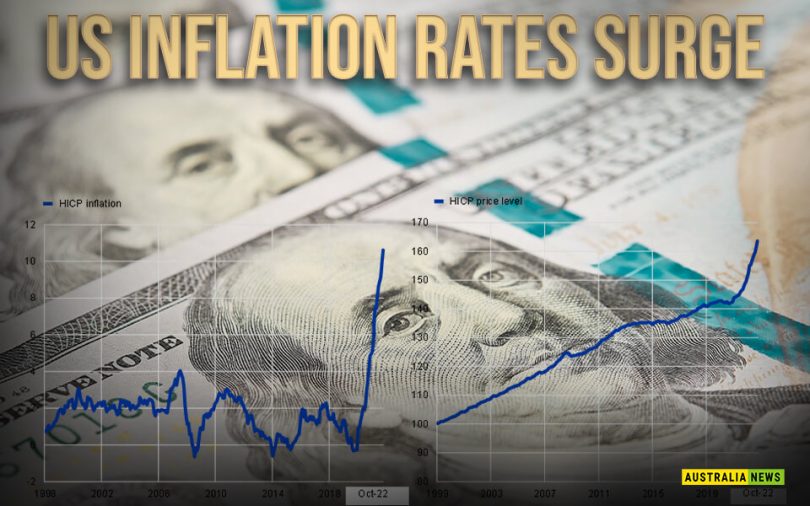

The US Bureau of Labor Statistics reported that consumer prices increased by 0.9% in April, the largest monthly rise since 2009. This surge in inflation was primarily driven by higher prices for used cars, gasoline, and food, which have been in short supply due to supply chain disruptions and other pandemic-related challenges.

This news sent shockwaves through the markets, with investors worried about the potential impact of rising inflation on corporate profits and economic growth. The local market was not immune to these concerns, with several major stocks taking a hit in early trading.

Analysts have been warning for months about the risks posed by inflationary pressures, and this latest data will only add to those concerns. While some investors remain optimistic about the prospects for the global economy, many are now looking for ways to hedge against the potential impact of rising prices.

Overall, it is a challenging time for investors, and there is no clear consensus on the best path forward. However, one thing is certain: the latest inflation data has added a new layer of uncertainty to an already complex economic landscape.

- Published By Team Australia News